Repo Rate Unchanged: The Reserve Bank of India (RBI) on Thursday (August 10) left its key interest rates unchanged for a third straight meeting but signalled tighter policy if food prices drive inflation higher. The monetary policy committee, which has three members from the central bank and a similar number of external members, held the benchmark repurchase rate (repo) at 6.50% in a unanimous decision.

Prior to that, it had raised interest rates by 250 basis points (bps) since May 2022 in a bid to cool surging prices.

Also Read: RBI MPC Decision: Is There Any Impact On Home Loan EMIs? What Borrowers Must Know

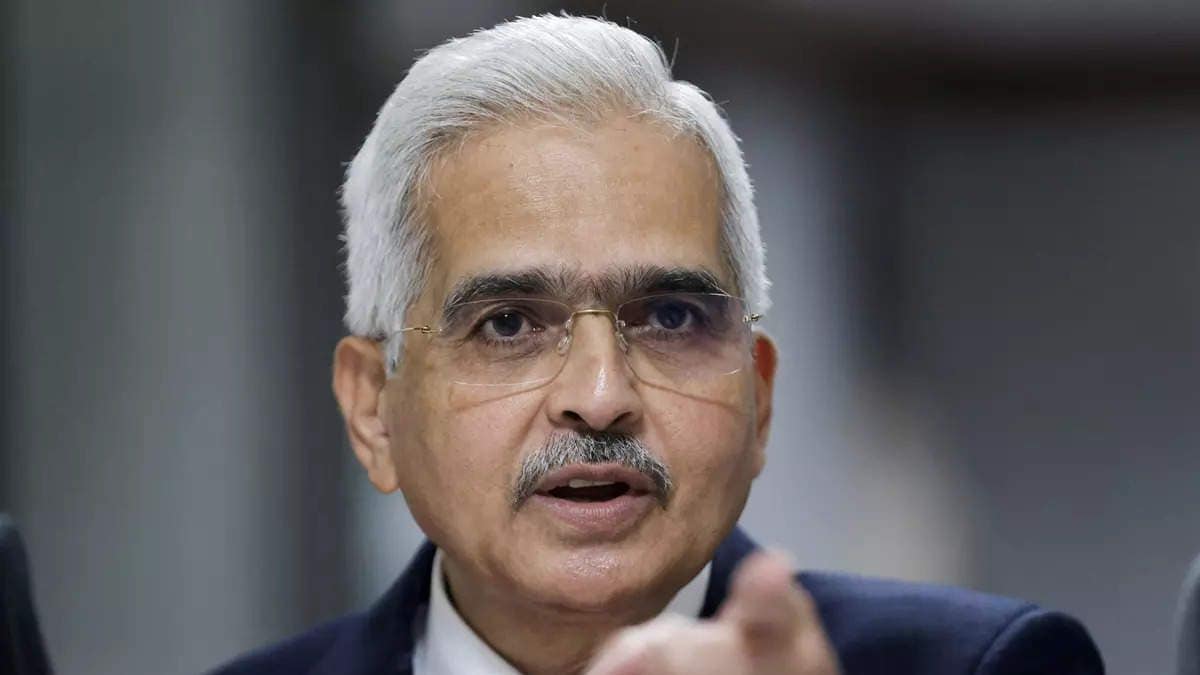

It retained the stance on ‘withdrawal of accommodation’ but Governor Shaktikanta Das sounded hawkish when he highlighted that headline inflation needs to subside sustainably below 4% and any surge in the inflation print, if continued for a longer period, may necessitate fresh action.

Key Outcomes

The hawkish stance was also reinforced by the unexpected announcement of reducing the cash in the banking system by raising the incremental cash reserve ratio (ICRR) to 10% on the incremental NDTL (net demand and time liabilities) over the last 3 months. This will help in absorbing a large part of the excess liquidity created through the return of the Rs 2,000 notes and the large dividend to the government from RBI.

The move is expected to suck out about Rs 1 lakh crore from the banking system, he said, adding that this liquidity tightening measure will not impact credit needs of productive sectors.

Why RBI Couldn’t Touch Repo Rate?

“The job on inflation is still not done,” Governor Das said.

“Inflationary risks persist amidst volatile international food and energy prices, lingering geopolitical tensions and weather-related uncertainties.”

Also Read: UPI Lite: RBI Raises Per Transaction Limit To Rs 500 from Rs 200 To Promote Digital Transaction

The RBI raised its inflation forecast for the current financial year ending March 2024 to 5.4% from 5.1% earlier, citing pressures from food prices. In the July-September quarter, it saw inflation at 6.2%, significantly higher than the 5.2% earlier forecast.

“We do look through idiosyncratic shocks but if it shows signs of persistence, we have to act,” he said.

The MPC drew confidence from moderation in core prints and expects a seasonal correction in food prices in the fourth quarter of 2023.

RBI retained its projection for Indian economic growth at 6.5% for the current 2023-24 fiscal year (April 2023 to March 2024).

“Aggregate demand conditions continue to be buoyant,” Das said.

Inflation Remains a Key Reason

Food price spikes in India, typical at the onset of the monsoon, drove up headline inflation in June, snapping a four-month downward trend.

Headline inflation, after reaching a low of 4.3% in May 2023, rose in June and is expected to surge during July-August led by vegetable prices.

Also Read: RBI Checks Surplus Liquidity In Banking System, Mandates Additional CRR Of 10%

“While the vegetable price shock may reverse quickly, possible El Nino weather conditions along with global food prices need to be watched closely against the backdrop of a skewed south-west monsoon so far,” Das said.

“These developments warrant a heightened vigil on the evolving inflation trajectory.”

The MPC, he said, “remains resolute in its commitment to aligning inflation to the 4% target and anchoring inflation expectations”.

“Bringing headline inflation within the tolerance band is not enough; we need to remain firmly focused on aligning inflation to the target of 4.0%,” he said.

What Experts Said?

Amar Ambani, Group President & Head – Institutional Equities, Yes Securities, said, “RBI decided to hold the interest rates steady, along expected lines. However, on the inflation front, the Central Bank sounded cautious, citing price pressures in the food basket and has revised its inflation outlook for FY24 to 5.4% from 5.1% earlier.”

“The July Consumer Price Index (CPI) is anticipated to rise as high as 6.5-7.0%, primarily driven by inflation in perishable commodities. Nonetheless, we believe that this effect is transient; we expect the price pressure in perishable commodities to ease as we approach November – December 2023, which marks the onset of Rabi season. As for the interest rate outlook, the possibility of a rate cut is entirely ruled out for FY24,” Ambani added.

Shishir Baijal, Chairman & Managing Director, Knight Frank India, added, “The choice to maintain the status quo is supported by strong economic conditions and the revised inflation forecast for FY24 falling within the central bank’s upper tolerance range of 6%.”

However, Baijal underlined that the central bank remains watchful on inflationary expectations and is focused on bringing the inflation level to its 4% target. Measures to reduce excess liquidity, with temporary tightening through incremental Cash Reserve Ratio at 10%, aligns with price stability goals of the central bank. Maintaining policy rates will bolster consumer demand amid moderate inflation, further promoting economic growth.

Deepak Agrawal, CIO- Fixed Income, Kotak Mahindra Asset Management Company, said, “RBI prefers to be in ‘wait and watch’ mode to check if the recent food price inflation is getting generalised and prefers to keep rates on hold and keep the monetary policy unchanged.”

Jyoti Prakash Gadia, Managing Director at Resurgent India, too highlighted that the uncertainties created due to short-term shocks of food inflation and uneven monsoon have led RBI to adopt a wait-and-watch approach.

“The status quo in the stance of withdrawal of accommodation is also on expected lines given the volatility and the need for supporting growth. Accordingly, the GDP target rates have not been changed,” Gadia added.

(With agency inputs)